When a wealth management professional retires, it’s important to ensure his or her clients make a seamless transition to another adviser at the firm, says Barbara Archer, partner and managing director at HighTower St. Louis Wealth Advisors in Brentwood. According to a recent study published by Deloitte, it’s an issue that is gaining a lot of attention as wealth advisers are aging out of the field faster than they can be replaced.

Archer says HighTower avoids disruption by using a collaborative approach to client service. “We are structured differently than a lot of other wealth management providers,” she explains. “As an ensemble firm, we work as a team as opposed to siloed firms where advisers are in competition with each other. At HighTower, we cross over for the benefit of clients because we want them to have access to all of our diverse areas of expertise.” The firm’s eight-person wealth adviser group is an even mix of men and women, and four administrative team members assist them in providing a high level of client attention, according to Archer. HighTower offers services in investment, taxes, estate planning, giving, cash flow and risk management.

Archer says HighTower avoids disruption by using a collaborative approach to client service. “We are structured differently than a lot of other wealth management providers,” she explains. “As an ensemble firm, we work as a team as opposed to siloed firms where advisers are in competition with each other. At HighTower, we cross over for the benefit of clients because we want them to have access to all of our diverse areas of expertise.” The firm’s eight-person wealth adviser group is an even mix of men and women, and four administrative team members assist them in providing a high level of client attention, according to Archer. HighTower offers services in investment, taxes, estate planning, giving, cash flow and risk management.

The firm starts planning for smooth transitions at the outset of each client relationship. “When a new client comes in, we prepare a smartboard presentation and have two or three professionals present, including a lead adviser,” Archer notes. “As we get to know the client, these staff members also attend strategic review meetings so the relationships stay firmly in place. We create a detailed financial plan for each client, and we all listen carefully to his or her needs.” That way, if a transition is necessary, the team is highly familiar with the client and family and can continue providing advice without interruption.

A common concern among clients is how to properly entrust a business or portfolio to the next generation. “We have a lot of experience helping families succeed,” Archer says. “Many of our clients are self-made business executives, entrepreneurs, lawyers, doctors and CPAs. We help with long-range planning and even use the services of a psychologist to determine which family member might be best suited to take over a business. We follow a very thorough and thoughtful process.”

The firm’s commitment doesn’t stop at the office. HighTower staff members serve on nonprofit boards and spend many hours outside of work helping clients engage in community activities as a way of giving back. “Too often, members of our industry focus only on monetary treasures,” Archer says. “It’s important to us, though, to make sure people think about community treasures like the Shakespeare Festival, zoo or art museum. We enjoy putting on client events that tie in with these institutions, and we think it’s especially important to involve young family members. It’s easier to give guidance on invested dollars when we can see firsthand what is meaningful to the people we serve.”

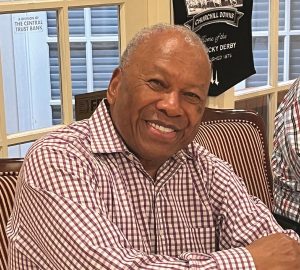

Hightower St. Louis Wealth Advisors is led by Barbara Archer, CFP, CLU, AEP; Carol L. Rogers, CPWA; and Omar Qureshi, CIMA, CPWA. The firm advises clients about investment, tax, estate planning, cash flow, philanthropy and risk management matters. Pictured on the cover: Brian Copeland, Barbara Archer, Omar Qureshi and Carol Rogers. For more information, call 314.598.4060 or visit hightowerstl.com.

Cover design by Allie Bronsky

Cover photo by Tim Parker Photography

Pictured above: The Hightower St. Louis Wealth Advisors group.