We all rely on our banks for basic necessities like getting cash from the ATM and depositing paychecks, but we don’t always think about the integral part they can play in bolstering the local economy. Deposits we make can help fund local businesses through loans, which in turn can create revenue and job opportunities. Reliance Bank is dedicated to its role of serving the community. With more than 20 branch locations in the St. Louis metropolitan area, it uses its $1.4 billion in total assets to help businesses grow and develop while also offering customers personal service.

“We’re a community bank that is locally owned and locally managed,” says Reliance chairman and CEO Thomas H. Brouster. “We look for small to medium companies that need help expanding in the communities where our branches are located. We aim to boost local development.” While larger companies may be selling to out-of-town conglomerates, Reliance focuses on those that help build the local economy and fill job voids. “St. Louis is built on middle-market businesses, and they need good banks that can help them grow,” says Reliance executive vice president and chief lending officer Norm Toon. “We love being a part of a company’s history. Our assistance enables innovation and helps companies become the next big thing in their fields.”

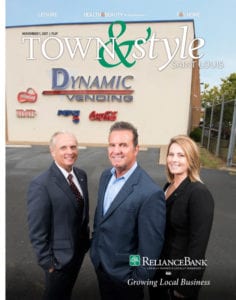

Dynamic Vending is one such success story. Reliance assisted the vending machine supplier with an owner-occupied loan, a type available to businesses that own their buildings and occupy at least 50 percent of the property. Brouster explains that this type of loan is great for helping companies expand in terms of space, technology and renovations. Dynamic Vending needed to renovate its warehouse and implement new technology to keep track of inventory and effectively manage delivery routes. “The machines Dynamic Vending installed and its warehouse renovation will help its operations double in size without the need for more space,” Toon says. “These advancements allow the company to streamline, doing twice the business with the same footprint.”

Dynamic Vending is one such success story. Reliance assisted the vending machine supplier with an owner-occupied loan, a type available to businesses that own their buildings and occupy at least 50 percent of the property. Brouster explains that this type of loan is great for helping companies expand in terms of space, technology and renovations. Dynamic Vending needed to renovate its warehouse and implement new technology to keep track of inventory and effectively manage delivery routes. “The machines Dynamic Vending installed and its warehouse renovation will help its operations double in size without the need for more space,” Toon says. “These advancements allow the company to streamline, doing twice the business with the same footprint.”

Part of the success of Dynamic Vending’s expansion is the strong partnership it formed with Reliance. “We listened to their needs and provided ideas to help them with their plans,” Brouster says. This personal engagement and investment in clients’ success is key. “Every time a company needs to expand or upgrade, it’s quite an investment for them,” Toon notes. “We can help them determine what is good for their business.” Dynamic Vending owner Joshua Koritz appreciates the attention. “I really like that I can call my banker at Reliance to throw ideas around and get opinions, even after hours or on the weekend,” he says. “Reliance is always there for me, and I’m not treated as just a number. It’s a good partnership.”

Loans are only part of what Reliance offers businesses and individuals. The bank has a well-rounded array of services to cover any banking need for clients. Its local operations also mean that customers get more direct service, with questions answered and decisions made in a timely manner. As Brouster says, “That’s what a bank is supposed to do.”

Reliance Bank is locally owned, full-service community bank with more than 20 branches throughout the St. Louis Metropolitan region. It provides financial solutions and unmatched service to individuals, professionals, small businesses and commercial customers. For more information, call 314.569.7200 or visit reliancebankstl.com.

Photo | Tim Parker Photography