Marvin Mitchell decided to become a financial adviser after watching his grandmother suffer the effects of inappropriate retirement planning services. “She had cancer, got the wrong kind of advice for her needs, and ended up having to spend down her assets on medical care,” says Mitchell, president and CEO of Compass Retirement Solutions. “That shouldn’t have happened, and it motivated me to get into the field myself. I wanted to provide clients with customized services that would focus on their unique requirements.”

After working in the industry for about eight years, the St. Louis native launched his Creve Coeur-based company, assembling a team of certified financial advisers and staff who are guided by clients’ needs and goals. Compass provides retirement services in the areas of income, investment, taxes, legacy planning and health care.

Mitchell says he originally worked for large advisory firms but felt compelled to improve on existing retirement planning models when he opened his own business. “Wall Street advisers usually handle clients’ money in two ‘buckets,’” he explains. “They are liquidity, which includes things like cash in savings or checking accounts, and growth, which is subject to the risks of the stock market. Our model adds a third bucket we call ‘safety,’ which involves placing a part of the portfolio in another vehicle that will protect it. If the market goes down, the money will be safe, and if it goes up, there’s opportunity for the money to grow.”

Mitchell says he originally worked for large advisory firms but felt compelled to improve on existing retirement planning models when he opened his own business. “Wall Street advisers usually handle clients’ money in two ‘buckets,’” he explains. “They are liquidity, which includes things like cash in savings or checking accounts, and growth, which is subject to the risks of the stock market. Our model adds a third bucket we call ‘safety,’ which involves placing a part of the portfolio in another vehicle that will protect it. If the market goes down, the money will be safe, and if it goes up, there’s opportunity for the money to grow.”

According to Mitchell, a truly diversified portfolio is one that protects clients by balancing all three buckets. “This puts them in a more comfortable retirement position,” he explains. “True diversification is an area more advisers need to focus on right now. The average bull market lasts about 54 months, but we have been in the current one for about 120, so a change definitely is coming.”

In addition to making clients’ portfolios more secure, Mitchell’s firm also helps them keep pace with inflation and get a reasonable rate of return on investments. And because retirement planning can be complex, Compass advisers strive to make the process easy to understand. They offer a free, no-obligation initial consultation and prepare a ‘one-page blueprint’ of each potential client’s financial life, Mitchell says. “The blueprint includes a portfolio stress test to determine if they are taking on too much risk,” he notes. “It also provides an income plan and shows where they are from a tax standpoint. We view this first meeting as a chance to get to know each individual personally.”

Compass advisers are fiduciaries, which means they have a responsibility to put clients’ interests first. Many of the firm’s clients are nearing or already in retirement, so their needs often are pressing, according to Mitchell. He says it’s satisfying to help them save money and feel more confident through a better understanding of their finances. He also enjoys sharing knowledge by hosting regular radio programs and putting on educational events for clients. “Our firm sees retirement planning as a team effort,” he says. “We encourage people to reach out and learn how we can help.”

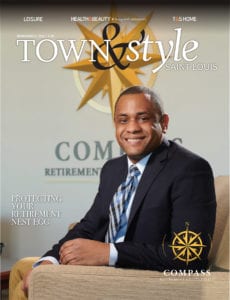

Compass Retirement Solutions offers personalized retirement services in the areas of income, investment, tax, legacy planning and health care. Pictured on the cover: President and CEO Marvin Mitchell. For more information, call 314.373.1598 or visit compassretirementsolutions.com.

Cover design by Julie Streiler

Cover photo by Tim Parker Photography

Pictured above: Marvin Mitchell with Airionne Givens and Patrick Ritter